In this issue

1101 K Street,

NW, Suite 650

Washington DC 20001

(202) 471-3962

www.insurancecompact.org

Follow us on Social Media!

LinkedIn: @Insurance-Compact

Twitter: @InsCompact

Letter from Karen Schutter, Executive Director

Season’s greetings from the Compact! This is the last issue of the Compact Chronicles in 2024, and it’s hard to believe the new year is upon us. Before we ring in 2025, it’s important to reflect on how much the members accomplished this year; this edition helps you do that by summarizing all the highlights from 2024.

The Compact Office also released its 5th annual report covering annual and triennial rate schedule certifications on Compact-approved individual long-term care insurance products. The public report can be found on our website under Regulator Resources. Confidential, state specific reports will be sent to each member participating in long-term care uniform standards. We will send these reports in January.

End-of-year Committee surveys have been sent out. It will only take a few minutes to complete, and we encourage all member regulators to provide feedback as to how to improve the committee process for 2025. If you are a member of a committee but have not received the survey, please send an email to comments@insurancecompact.org.

We sincerely hope you enjoy the holiday season. Please note that the Compact Office will be closed from December 25 to January 1, with staff checking in periodically. We will resume normal business operations on Thursday, January 2. The Compact has many goals to achieve in 2025, and we look forward to working with each and every one of you!

We are grateful for the opportunity to serve our members, and we are here to provide whatever support they need.

Member Corner

For this edition, we profile Maryland Insurance Commissioner Marie Grant!

Marie Grant has been appointed Maryland Insurance Commissioner by Governor Moore effective October 1, subject to confirmation by the Maryland Senate. Marie believes access to quality insurance products for Marylanders is critical to making Maryland more competitive, safer, and more affordable. Marie Grant is an attorney and state and federal policy expert with over 20 years of experience in policy, strategy, and regulation in both the public and private sector, mainly in the fields of insurance and health care payment. Her previous roles include Assistant Secretary for Health Policy at the Maryland Department of Health and Vice President of Public Policy at CareFirst BlueCross BlueShield.

Marie started her career at the Maryland Department of Legislative Services as non-partisan committee counsel to the House Health and Government Operations Committee and the Senate Finance Committee where she advised the committee on health, life, and malpractice insurance legislation, as well as consumer protection.

Marie received her B.A. in public health from the Johns Hopkins University and her J.D. from Georgetown University Law Center. She lives in Catonsville with her husband and family. Marie enjoys spending time with her family and 2 cats, driving her kids to their various activities, running slowly, and enjoying all the Baltimore region has to offer.

Uniform Standards Adopted in 2024

Several new or amended Uniform Standards were adopted this year:

ANNUITIES

- Standards for Individual Deferred Index Linked Variable Annuity Contracts (Commonly Marketed as Registered Index Linked Annuities)

- Additional Standards for Market Value Adjustment Feature for Modified Guaranteed Annuities and Index Linked Variable Annuities

- Additional Standards for Index-Linked Crediting Feature for Deferred Non-Variable Annuities and the General Account Portion of Individual Deferred Variable Annuity Contracts

- Additional Standards for Bonus Benefits (for Individual Deferred Non-Variable Annuities)

- Additional Standards for Market Value Adjustment Feature Provided Through the General Account

- Additional Standards for Bonus Benefits for Individual Deferred Variable Annuity Contracts

- Additional Standards for Guaranteed Minimum Death Benefits for Individual Deferred Variable Annuities

- Additional Standards for Waiver of Surrender Charge Benefit

DISABILITY INCOME (including five-year review)

- Group Disability Income Policy and Certificate Uniform Standards

- Uniform Standards for Group Disability Income Insurance Enrollment Forms and Statement of Insurability Forms

- Uniform Standards for Group Disability Income Insurance Statement of Insurability Change Form

- Uniform Standards for Riders, Endorsements or Amendments Used to Effect Group Disability Income Insurance Policy Changes

- Uniform Standards for Riders, Endorsements or Amendments Used to Effect Group Disability Income Insurance Certificate Changes

- Uniform Standards for Group Disability Income Insurance Initial Rate Filings

- Uniform Standards for Filing Revisions to Rate Filing Schedules in Group Disability Income Insurance Policies

MULTI-LINE

LIFE INSURANCE

- Group Whole Life Insurance Policy and Certificate Standards

- Uniform Standards for Group Whole Life Insurance Enrollment Forms and Statement of Insurability Forms

- Uniform Standards for Group Whole Life Insurance Statement of Insurability Change Form

- Uniform Standards for Riders, Endorsements or Amendments Used to Effect Group Whole Insurance Certificate Changes

- Uniform Standards for Riders, Endorsements or Amendments Used to Effect Group Whole Life Insurance Policy Changes

- Group Whole Life Insurance Uniform Standards for Accelerated Death Benefits

- Group Whole Life Insurance Uniform Standards for Accidental Death Benefits

- Group Whole Life Insurance Uniform Standards for Accidental Death and Dismemberment Benefits

- Additional Standards for Waiver of Premium Benefits for Total Disability and Other Qualifying Events for Whole Life Insurance Policies and Certificates

- Additional Standards for Graded Death Benefits for Whole Life Insurance Policies and Certificate

- Group Term Life Insurance Policy and Certificate Standards

- Uniform Standards for Group Term Life Insurance Enrollment Forms and Statement of Insurability Forms

- Uniform Standards for Group Term Life Insurance Statement of Insurability Change Form

- Uniform Standards for Riders, Endorsements or Amendments Used to Effect Group Term Insurance Certificate Changes

- Uniform Standards for Riders, Endorsements or Amendments Used to Effect Group Term Life Insurance Policy Changes

- Group Term Life Insurance Uniform Standards for Accelerated Death Benefits

- Group Term Life Insurance Uniform Standards for Accidental Death Benefits

- Group Term Life Insurance Uniform Standards for Accidental Death and Dismemberment Benefits

- Group Term Life Insurance Uniform Standards for Waiver of Premium While the Certificateholder is Totally Disabled

2024 Compact Highlights

Compact Roundtables

Two Roundtable events were held this year, the first in Washington, D.C. on May 15 and the second in Omaha, NE on October 30. The first Roundtable consisted of three breakout sessions with a group discussion at the end. The first breakout session was an opportunity for members of the industry to share with regulators what areas of the Compact process they should be focused on improving. The second breakout session focused on the reasons for not filing with the Compact. The third breakout session generated ideas for adjunct services including suggestions for a pilot and a product innovation forum.

The second Roundtable also consisted of three breakout sessions. The first session included a discussion focused on the goals of the framework and pre-filing questionnaire exposed by the Adjunct Services Committee. Attendees had the opportunity to apply the framework and questionnaire to a fictional product scenario during the second breakout session. The third breakout session offered participants the opportunity to exchange perspectives on the Insurance Compact and offered suggestions for improvements.

Strategic Plan

The Commission adopted Compact Compass 2.0, the Compact’s next Strategic Plan, during its Annual Meeting in Denver, CO. The source of the action items is strategic plan interviews conducted with the membership and stakeholder committees, as well as feedback from the Compact Roundtables. The updated strategic plan will serve as a compass for the next three years and beyond.

Member Outreach

The Compact Office advanced several member communication initiatives in 2024. We held several monthly member state life calls to discuss questions and regulatory issues around Product Filings and Pre-Filing Communications. We continued to offer spring and fall webinars for member states and other interested parties. We have also set up pages on Member Connect for the Insurance Compact, Product Standards Committee, and Adjunct Services Committee.

Other Accomplishments

- South Dakota joined the Compact as its 48th member.

- The Compact Bylaws were amended to allow for more flexibility in filling and sustaining the service of former Compact Officers to serve as the ex-officio Past Chair.

- Governance training sessions were held for members and their designated representatives.

- The Commission adopted its budget and the Uniform Standards Development Prioritization list for 2025.

- The Compact Office hired two new employees: Jenny Sieben, Product Reviewer, and Cara Shackelford, Regulatory Research Specialist.

CAC Spotlight

Meet Chris Kite!

Chris Kite helps a wide range of people with family history and life insurance. He has given presentations around the country on Genealogy, History, Life Insurance, Legacy Planning, and how our genes and memes, that is our DNA and spiritual roots, connect us all as cousins and as spiritual brothers and sisters.

From 2016 to 2018, he served as the president of the Afro-American Historical and Genealogical Society (AAHGS) in Charlotte. He also served on the board of www.MeckMin.org an interfaith organization in the Charlotte NC area.

Chris is the descendant of Lutheran ministers in the Shenandoah Valley of Virginia, Baptist farmers east of Kansas City Missouri, Catholic farmers near Chicago, and Danish Mormon handcart pioneers.

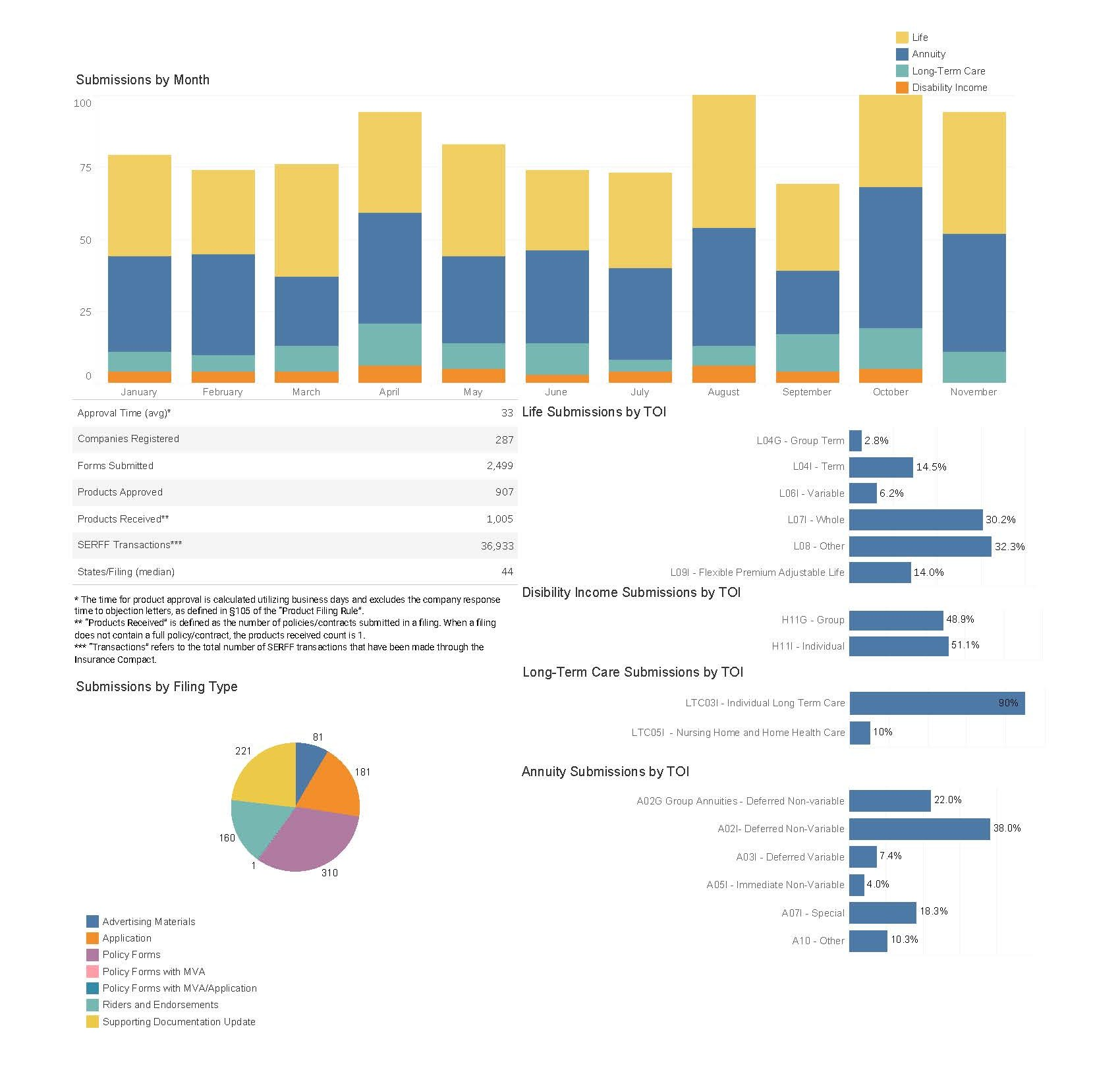

Compact Product Filing Statistics

As of November 30, 2024